A card reader in the financial blood that runs through your business. If transactions aren’t seamless, you can run into some big cashflow issues as a small business. So, with that in mind, here are the 10 best card machines or card readers built specifically for small businesses in the UK.

Best Card Readers for Small Businesses

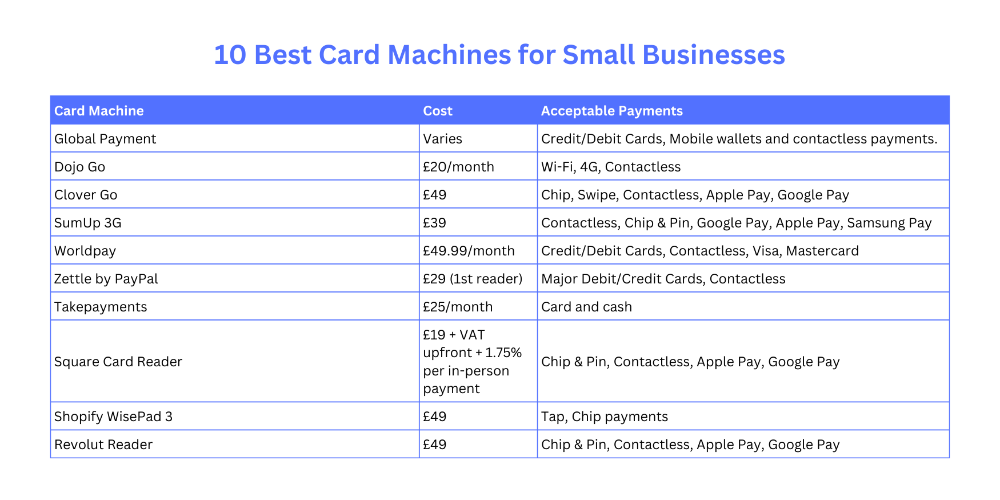

Global Payments

Cost: Varies - Get a quote

The Global Payments card reader offers a secure and seamless payment solution tailored for the hospitality and other sectors. It smoothly integrates with the comprehensive POS ecosystem, perfect for restaurants, pubs, takeaways, cafes, bakeries, hotels, and events. It’s a 360° solution for handling all parts of your hospitality business through a cloud-based management system which allows you to process payments on the move via mobile data terminals, online and in-store.

Pros

- Sophisticated transaction management system.

- Cloud-based on-the-move technology to take payments anywhere.

- Securely accepts cards, mobile wallets (Apple Pay & Google Pay), and contactless payments.

- Specialises in the hospitality and restaurant industry, so lots of additional features.

Cons

- Relies on a stable internet connection for real-time transaction processing.

- Additional hardware might be necessary for specific operational needs.

Dojo Go

Cost: £20 per month.

Dojo Go is fast, secure, and one of the best card machines for small businesses. With seamless Wi-Fi and 4G payments anytime, Dojo Go offers a fast, secure, and user-friendly mobile card machine for small business owners in the UK. Designed with both Wi-Fi and 4G connectivity for fast payments on the move, Dojo Go integrates with over 400 EPOS systems for optimal efficiency and uninterrupted service throughout the long, 10-hour battery life. As well as peace of mind with every transaction, Dojo Go gives control back to the business owners and their customers at a price that suits their needs

Pros

- Wi-Fi and 4G enabled.

- 10-hour battery life.

- Point-to-point encryption.

Cons

- Costs £20 per month.

- Vulnerable to network connectivity issues in areas with poor Wi-Fi or 4G reception.

Clover Go

Cost: £49

The Clover Go fmCard Reader is specially designed for small businesses, offering a versatile and compact payment solution. It lets you accept chip, swipe, and contactless payments on the go through a variety of payment links, including cards, Apple Pay, and Google Pay. You can easily attach the reader to your phone or tablet to process transactions, manage orders, and track sales. It’s compact and easy to carry, so you can take it to your customers, wherever they are.

Pros

- Accepts chip, swipe, and contactless payments.

- Plugs into your mobile phone or tablet for easy integration.

- Easy integration with existing accounting software and POS systems.

- Fully complies with July 2023 card reader regulations.

Cons

- You’ll need to pay a monthly fee for every device.

- The sales reporting is pretty basic compared to other providers.

SumUp 3G

Cost: Starting at £39 (excluding VAT).

The SumUp 3G Card Reader is another one of the best cashless payment solutions for small businesses in the UK. Its compact design and support for NFC technology allow the reader to accept various cashless payments, which include contactless, chip & pin, and, coming soon, Google Pay, Apple Pay, and Samsung Pay.

Additional features of the card reader include refund issuance, enabling tipping, and applying customised tax rates for varying items. The mobile card reader is also equipped with a reliable battery life, offering up to 800 transactions on a single charge, offering enhanced usability for off-site businesses.

Pros

- Accepts many payment methods, including contactless.

- Compact and portable design.

- Easy to issue refunds and enable tipping.

- Customisable tax rates.

- Long battery life for continuous use.

Cons

- Initial setup may require some technical knowledge.

- Printers are not included in this specific bundle.

Worldpay

Cost: Starting at £49.99/month for a fixed monthly plan or £17.95/month for a custom plan, with varying transaction fees.

Worldpay offers three different card machines for small businesses. The Desk 5000 is ideal for stationary vendors, offering a fast and reliable way for shops to accept payments over the countertop and till. The hospitality industry can take advantage of Axium DX8000, which allows customers to pay at their table via Bluetooth technology. Alternatively, the mobile Move 5000 means transactions can be accepted anytime, anyplace, over a mobile network connection.

All three systems allow vendors to accept various credit and debit card payments, with Visa and Mastercard, contactless payments, and email payments. They are fully IPC compliant and have fraud management tools.

Pros

- Allows you to control all your card transactions via one merchant ID.

- Mobile-friendly options are available.

Cons

- Monthly payments and varying transaction fees for both fixed and custom plans.

- Requires a minimum 18 month contract to merchant card machines.

Zettle by PayPal

Cost: First-card reader: £29 (excluding VAT). Additional card readers: £59 each.

Powered by PayPal, the Zettle card reader helps UK small businesses take the hassle out of payments with their sleek card reader. Designed specifically for small UK businesses, this card reader seamlessly fits in with your daily routine, both in-store and on-the-go, with an all-day battery life.

The readers accept most debit, credit and contactless payments. With no monthly fees and a simple transaction fee structure, they provide transparent pricing for budget-conscious businesses.

Pros

- Affordable one-time cost.

- Accepts major cards and contactless payments.

- Quick setup and easy integration with the Zettle app.

- Compact design for portability.

Cons

- Additional card readers come at an extra cost.

Takepayments

Cost: Starting at £25 per month.

Takepayments offers an affordable business cards solution with TakepaymentsPlus for UK small business owners. This terminal allows you to do way more than just accept card payments. It provides real-time reporting, tracking of stock, and quicker checkout processes. The countertop terminal ensures next-day settlement, no setup fees, and 24/7 UK support.

Their portable terminal offers payments within 50 metres through Bluetooth and has a reliable battery and lightweight design. For businesses that are on the go, such as food trucks and online delivery, the mobile terminal also has built-in GPRS SIM card connectivity, which means better signal strength for on-the-go payments.

Pros

- Real-time reporting and stock analysis.

- Next-day settlement on the countertop terminal.

- Portable terminal with connectivity via Bluetooth.

- Mobile terminal with connectivity via a built-in GPRS SIM card.

- No setup fees with countertop and portable terminals

Cons

- A monthly rental fee.

Square Card Reader

Cost: £19 + VAT upfront + 1.75% per in-person payment.

The Square Card Reader helps UK small business owners take payments quickly and reliably. This compact reader securely accepts chip and PIN cards, contactless cards, Apple Pay, and Google Pay.

With easy setup, businesses can start accepting payments within minutes, connecting wirelessly, and receiving funds in business bank accounts as soon as the next working day. With a simple, flat-rate card processing fee of 1.75% for each payment, the Square Card Reader is a reliable and affordable tool for businesses of all sizes.

Pros

- Accepts chip and PIN, contactless, Apple Pay, and Google Pay.

- Quick and easy setup.

- The integrated battery allows for extended use.

- Uncomplicated payment structure: flat-rate fee of 1.75% for each payment.

Cons

- It requires a compatible device with Bluetooth.

- Instant and same-day transfers cost a fee.

Shopify

Cost: £49

The Shopify WisePad 3 Card Reader, priced at £49, enhances the in-store POS experience for businesses trading in the UK. This versatile device simplifies credit and debit card transactions with a minimal footprint. The shopify card reader is compact and accepts a variety of tap and chip payments. With free shipping, a 30-day return policy, and 24/7 customer support, the WisePad 3 Card Reader offers a dependable and user-friendly payment solution for businesses in a retail environment.

Pros

- Simple to setup and very easy to use.

- Accepts tap and chip payments from different types of cards including credit card payments.

- It works perfectly with Shopify’s POS systems.

- 24/7 support and a 1-year warranty are standard.

Cons

- May not support all payment processors.

- Shopify only displays payment status and not detailed transaction information.

Revolut Reader

Cost: device priced at £49, transaction fees starting at 0.8% + £0.02 per transaction.

The Revolut Reader is one of the most adorable solutions for small business owners who can’t afford to invest in a merchant account for in-person payments. With its compact design and easy setup, businesses can accept payments swiftly, in under 3 seconds.

The device supports chip and PIN, contactless payments, and payments via Apple Pay and Google Pay. Pay at the till in less than 3 seconds. Users can access funds the next day, even on weekends and holidays. This is great for those who need to keep a tight watch on cash flow.

Pros

- Low transaction

- Supporting next-day settlement.

- Multi-currency support.

- Easy to set up and use.

- No subscription fees.

Cons

- Requires a Revolut Business account.

- Some users have reported occasional glitches with the card payment machine.

- Doesn't include a fraud prevention feature.

For almost 20 years, 3S POS has offered one of the most flexible EPOS systems to international brands such as Caffe Concerto, Maroush, Comptoir Libanais, Pepe’s Piri Piri, GDK and thousands more delighted customers.

If you are looking for a Restaurant POS system that will not just help you accept payments but effectively manage your menu, inventory, and much more, speak to our sales for a free demo.